Apple's Major India Push: What to Know

Apple is making a new push in India. At least two key drivers are at play: reducing supply chain dependence on China and expanding in the Indian market.

Apple’s CEO Tim Cook recently visited India to launch the company’s first two retail stores in the country. Cook also met with Indian Prime Minister Narendra Modi and other officials about a newfound investment in the country. Here’s what to know about Apple’s push — including its revenue in the region thus far, the state of the Indian smartphone market (and Chinese competitors), and the supply chain and geopolitical factors that could shape this effort’s success or failure. Brought to you by Global Cyber Strategies, a Washington, DC-based research and advisory firm.

The One-Liner

Apple is looking to make a significant push to expand further into India, which is driven by at least two significant factors: reducing supply chain dependence on China and capitalizing on the sheer size of the Indian market.

Apple’s India Push

On April 18, Apple CEO Tim Cook was in Mumbai, India for the launch of the company’s first in-country store. Two days later, Apple opened a second physical location in Delhi. “India has such a beautiful culture and incredible energy,” Cook said. “We’re excited to build on our longstanding history — supporting our customers, investing in local communities, and working together to build a better future with innovations that serve humanity.” The point was clear: India is a growing investment.

Then, on April 20, Apple’s Cook met with India’s Prime Minister Narendra Modi. Manveena Suri and Michelle Toh over at CNN have a great rundown of the post-meeting highlights, including quotes from notable officials. As they detail, Cook tweeted after that “from education and developers to manufacturing and the environment, we’re committed to growing and investing across the country.” Modi then tweeted that it was an “absolute delight” to meet Cook and to highlight the “tech-powered transformations taking place in India.” India’s IT minister tweeted:

Met with @tim_cook, CEO, Apple. Discussed deepening Apple’s engagement in India across manufacturing, electronics exports, app economy, skilling, sustainability and job creation especially for women. Jointly charting a long-term and strong relationship.

There are at least two significant drivers (among others) underway:

Apple’s desire to reduce supply chain dependence on China, and

Its interest in expanding further into the Indian market.

Apple Goal #1: Reduce Supply Chain Dependence on China

While not stated in these words, at least one significant driver of Apple’s India push is reducing its supply chain dependence on China. Moving some device manufacturing to India, and out of China, is one way to achieve that goal.

Apple’s dependence on Chinese manufacturing has always been a complicated question for the company. For years, it has exploited low-wage labor in China and indirectly benefited from the billions of dollars’ worth of subsidies and other benefits provided to its manufacturer. But Apple has become more concerned with its China dependence of late amid former President Trump’s US-China “trade war,” the COVID-19 pandemic, and more. In June 2019, Apple reportedly asked major suppliers to produce cost estimates of moving 15-30% of production capacity to Southeast Asia, amid concerns over trade war tariffs. In September 2022, JP Morgan analysts reportedly told clients that Apple would move 5% of its global iPhone 14 production to India by late 2022 and expand to 25% manufacturing capacity in India by 2025.

Ahead of Cook’s April 2023 visit to India, Apple said in a statement that:

Apple began manufacturing iPhone [sic] in India in 2017, and since then, the company has worked with suppliers to assemble iPhone models and produce a growing number of components. Apple’s work with Indian suppliers of all sizes supports hundreds of thousands of jobs across the country.

Apple accounted, by one estimate, for 12% of the value of India’s smartphone shipments in 2021 and for 25% of that value in 2022. Another estimate found that Apple made up almost half of India’s total smartphone exports from March 2022-March 2023, to the tune of approximately $5-5.5 billion. Per that estimate, Samsung followed with about $4 billion worth of exports. (Read more from TechCrunch’s Manish Singh here, focused on India tech and many of these Apple developments.)

In 2022, Apple also began moving some of its MacBook production out of China and to Vietnam, via its current, Taiwanese manufacturer Foxconn. One unnamed individual at Apple told Nikkei Asia late last year:

After the MacBook production shifts, all of Apple’s flagship products basically will have one more production location beyond China … iPhones in India and MacBooks, the Apple Watch and iPads in Vietnam. What Apple wants now is an ‘out of China’ option for at least part of production for all of its products.

Sure enough, in February 2023, Foxconn announced it would build a new, 111-acre factory outside of Saigon, Vietnam, as part of a reported $300 million investment in the country. This was a considerable expenditure. Additional reporting has said Apple is also looking to reduce dependence on Foxconn. But for now, at least, the Taiwanese manufacturer remains heavily involved in Apple’s device production efforts; it’s therefore less a reduction of dependence on Apple’s current supplier per se and more of an attempt to relocate the physical sites of device manufacturing beyond China.

Apple Goal #2: Strategic Expansion in India

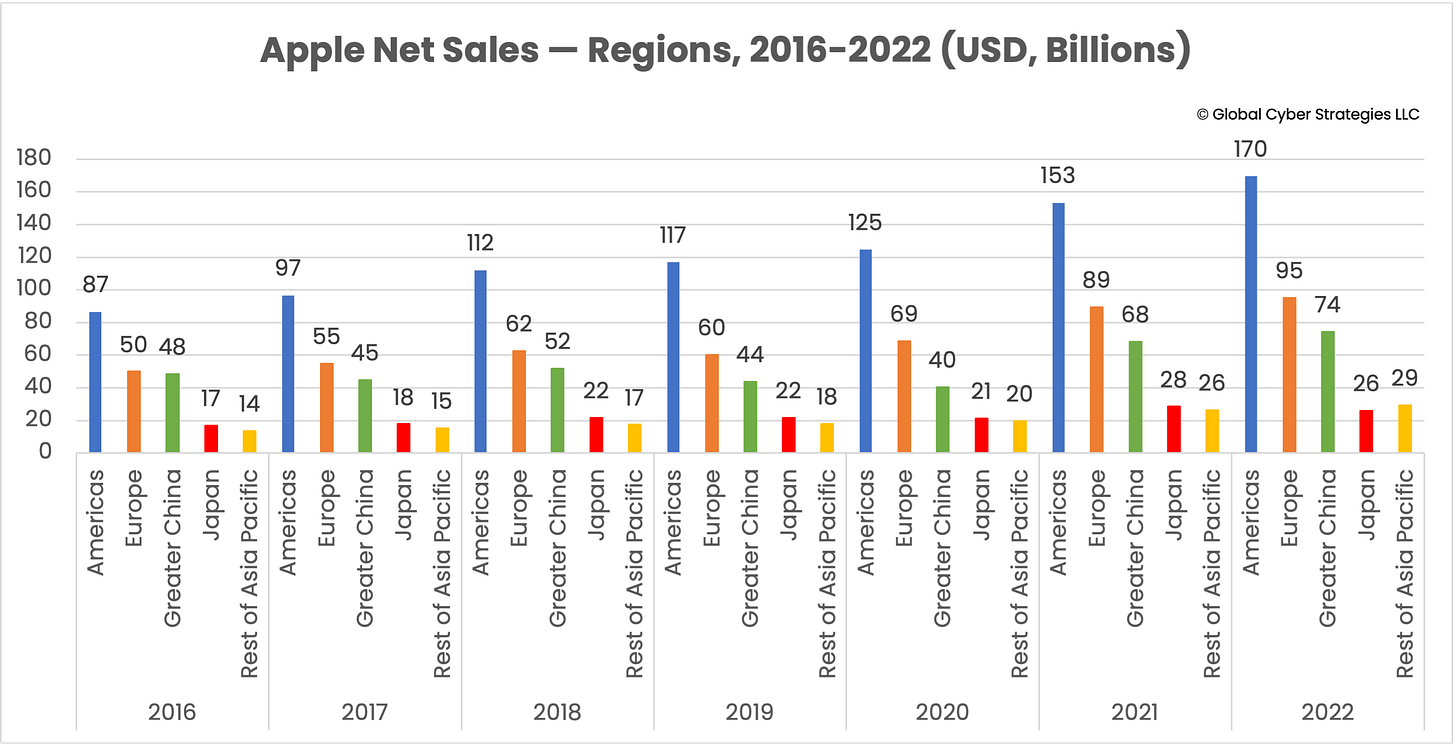

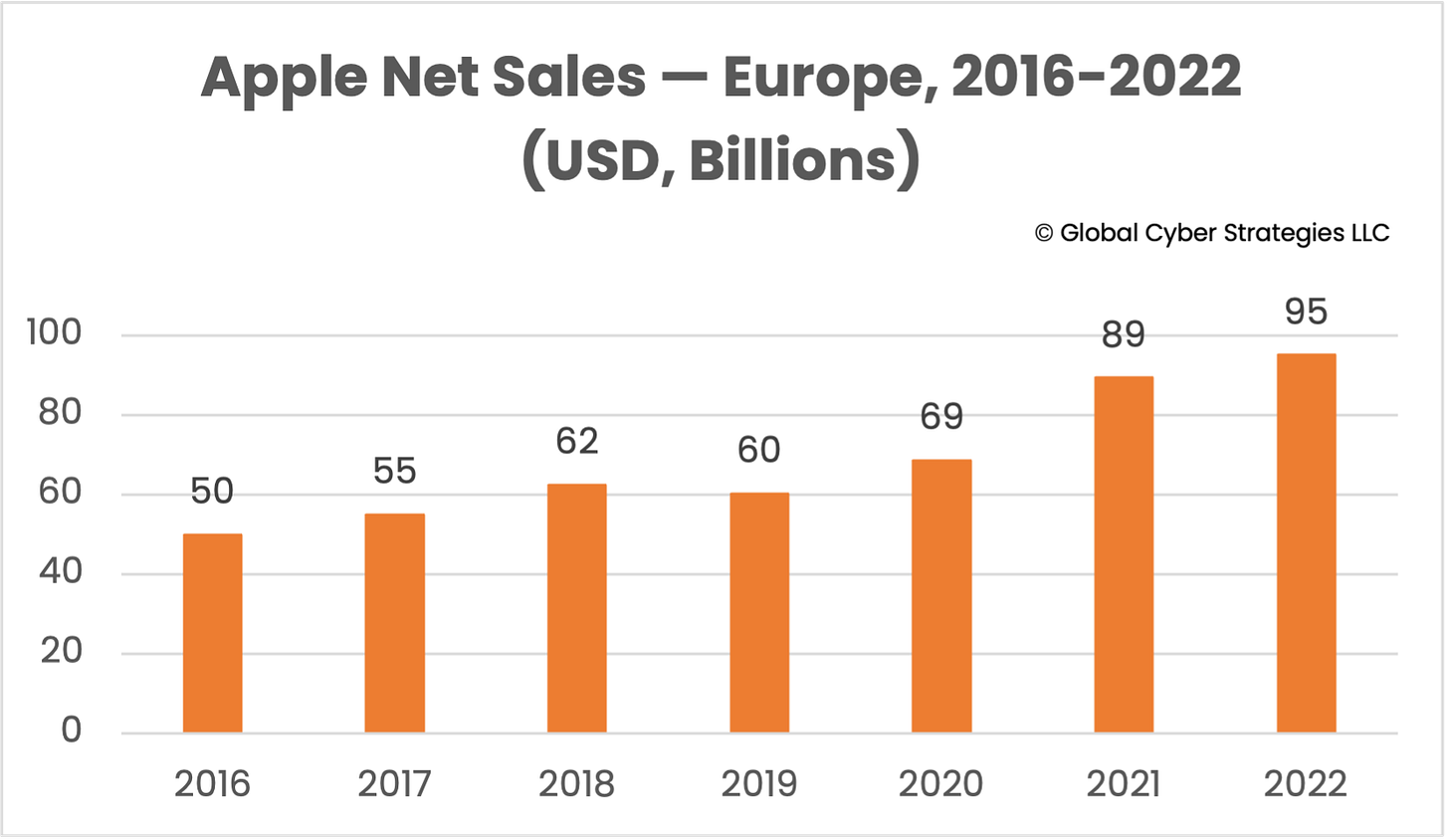

The second significant driver of Apple’s recent India announcement is to strategically expand in the Indian market. Apple’s net sales in Europe — which it counts in its annual filings as European countries as well as India, the Middle East, and Africa — have long been the second-strongest for Apple behind its net sales from the Americas.

The company’s net sales in its “Americas” segment (both North and South America) have long been about double those in its “Europe” segment. Nonetheless, Apple’s Europe segment net sales have grown alongside growth in other regions.

Zooming in further, Apple’s net sales in its “Europe” segment (again, including India, the Middle East, and Africa) went from $50 billion in 2016 to $55 billion in 2017, $62 billion in 2018, $60 billion in 2019 (a slight drop), $69 billion in 2020 (a strong recovery), $89 billion in 2021, and $95 billion (an all-time high) in 2022. Yet, as discussed below, likely only a small percentage of these net sales come from India.

Beyond Apple’s history here, India is now reportedly the most populous country on earth, with a population of over 1.425 billion people. Until recently, China held that title. As major US tech companies view it, India is a massive and important potential market for their products and services. India is also a geopolitically influential tech player (in every area from global internet governance to data privacy), the world’s most populous democracy, and home to a large and quickly growing technology sector. The government is additionally advancing incentivizes for companies to put electronics manufacturing, data storage infrastructure, and other technology in India.

Simultaneously, the room for growth — and the immense challenge — is there. Apple by one count controls less than 5% of India’s smartphone market share. In 2022 Q4, the market was controlled by Xiaomi (China), Samsung (South Korea), Vivo (China), OPPO (China), and realme (China). Apple was a small percentage (not even marked on market research firm IDC’s chart). There could be a political opportunity for Apple as well here: the Indian government is interested in expelling Chinese technology companies from China where it suits the competitiveness of Indian companies and/or where the Modi government can claim toughness against Beijing. Officials have mostly focused to date on Chinese mobile apps, not hardware (clearly, by the state of the smartphone market), but it’s possible the Indian government could take more action against Chinese smartphone manufacturers if Apple began to take a greater hold of the domestic market. Of course, that kind of move would also stand to benefit Samsung, even as it has sparred with the Indian government over subsidies.

Looking Ahead

This is just the beginning of Apple’s strong push to expand into India, including on device manufacturing. Its initial success remains to be seen, and the performance of Apple’s two new retail stores (in Mumbai and Delhi) will be one important data point for making that evaluation. So will Apple’s approach to device pricing in the market: most smartphones in India are currently sold for less than $250, but Apple is known for its more expensive devices and refusal to offer a wide range of price options.

All the while, numerous other geopolitical and political factors will greatly shape Apple’s prospects in the Indian market. These include India’s geopolitical positioning towards China; the Chinese government’s interest in pressuring Apple (or its Chinese manufacturers) to keep some supply chain nexus in China; Indian government pushes against Chinese technology; Apple’s investments in device manufacturing in India; and Apple’s ability to play into the Modi government’s vision for a domestic tech hub.

Subscribe for more public insights, and reach out on Global Cyber Strategies’ website for a range of custom-tailored research and advisory services.

—

© 2023 Global Cyber Strategies LLC.